Is Bitcoin The Future Or The Past?

With the latest crash in crypto here are some thoughts on Bitcoin moving forward. We have some general crypto thoughts at the end, but the bulk of this is in regards to Bitcoin specifically. I also did everything in my power to constrain myself from a 20 page rant on both Elon and Davos Man, and stick to the topic at hand.

ESG

Read the statement below. Obviously I highlighted a few parts. What do you notice?

Putting aside the fact that it was tweeted by a guy who is equal parts visionary and charlatan, and this was the case long before he waded into crypto, what you might notice is that Bitcoin is now an ESG issue.

ESG-Environmental, Social, and Corporate Governance has become an ever growing force to save the planet and save the people. For our purposes here we will ignore the fact that the main people pushing it fly around in private jets for their meeting and for everything else, that the average Davos attendee has the carbon footprint of a small country, etc. This is not a discussion about them.

ESG is a strong movement that has hit the investment space quite hard the last few years. If you want investment flows, better credit ratings, and to not be vilified you need to be steering your company towards better and more enlightened ESG based goals. ESG is not just financial but also political and societal. It might be the only movement right now that is even stronger than crypto.

All this to say that it would not be a surprise at all to see anyone holding BTC shamed into rethinking their crypto choice. If the ESG ratings come down on holders of BTC then you either lose fund flows, or you sell your coin. If you remember a few years back, there were marches in front of endowment offices to divest of any oil stocks that they held…and they divested of them. Even the Rockefeller family office came out a few years ago saying they didn’t hold any fossil fuel stocks anymore.

Bitcoin believers, Jack Dorsey being one, have come out saying that bitcoin can help grow sustainable energy. Dorsey put out a paper saying that bitcoin is becoming a force that will make the electrical grid greener by providing a financial incentive to make wind and solar more economical.

But then you see a piece like this that shows how Bitcoin can give coal plants a new life.

On one hand I kind of see what they are getting at. On the other hand, why don’t they mine some other crypto that uses less energy? Why does it have to be BTC? They can get paid AND use less energy.

How much power does BTC mining use? Here is a chart by Cambridge Centre for Alternative Finance showing BTC and ETH electricity usage vs different countries.

The other argument I have seen is that “other industries use a lot more power than bitcoin.” This is accurate but there are a few differences. One is that there is nothing else whose followers are claiming it is a “currency” that uses anywhere near this much power. Another is that aside from being an inefficient way to transfer money what is the use case for bitcoin? At least actual mining digs up iron and copper to make cars and computers and phones and…bitcoin mining rigs.

So how does this impact the future price of bitcoin? Well, if the marginal buyer is what drives the price higher, and the crypto world was expecting more hedge funds, family offices, endowments, pension funds, and the traditional asset management space into bitcoin and they don’t show…then the price of the coin is going down. Again, there are other coins, and they can make newer coins. I do not drive a Model T because there are better cars made today. Why would we not move on from bitcoin?

Of course, maybe this is yet another big piece of…noise. BTC has made it through plenty of hate so far so who knows, but ESG is a hit that could be fatal in a relative sense. Other coins don’t use nearly as much energy for their blockchains. Even ETH is an option to overtake the king.

CCP

Another impediment for Bitcoin, and possibly banks and other regulated financial entities, is the idea of holding assets that are controlled by China.

Despite Bitcoin being the libertarians dream the reality is that what the coin could be like is not what it currently is like. A super distributed network ensures that it is very hard for one person or one group to control over 50% of the network. That is not how it has played out.

If you read the article in the link below you can see how what was long assumed, has been at least mostly confirmed. China has more than 1/3 of the mining power, and very likely already has more than 50%.

Fortune article on BTC, Mining, and China

Another problem is that even if China is just short of 50% they can lean on Bitmain, the primary mining rig manufacturer, to get enough rigs to control over 50% of the global mining network.

This means that they can vote for whatever changes they want to Bitcoin. Now some have pointed out that the rest of the network can then go and fork into a new coin and even call it Bitcoin if they want. But the problem there is that the bad actor can then come over and do the same again and again. How much is a “secure” network worth that can be disrupted every time it is fixed?

Banks and central banks do not exactly go out of their ways right now to hold more RMB than is necessary. Do you think they will be in a hurry to load the boat on a new coin that China could essentially hijack?

Will China do this? I have no clue. Can they do this? I have no doubt.

Once again why does it have to be Bitcoin?

Regulation

In the last few days, we have seen China tell its banks that they cannot transact in crypto. We then saw the US Treasury say that any transaction of $10k or more in crypto had to be reported. Do you think this is the end?

The NY AG office is investigating Tether right now. The final results are still unknown, but Tether looks either very fraudy or very incompetent. Neither is a good look.

It doesn’t sound like Yellen likes crypto in its current state very much. It is clear that the CCP is less than enthusiastic about it as well.

Believers will say “it is an independent network so we can always move money independent of the government.” And while they are right on the move money part of the equation, the real question is what does that do to the value of the currency?

Usually “contraband” that is used in transactions-think stolen art- is marked down 80-90%. A stolen Picasso is not worth a lot on the black market because the heat is on and anyone that wants to google it can find out it is stolen. Even some Bond villain will not pay top dollar because he doesn’t have to.

So, if there are strict penalties for using BTC then what is the value? Probably not the bagillion dollars the believers claim it will go to.

We will see what happens here, but the current trend is less than bullish.

Use Case-Origin

One question that came up the other day in a good Twitter Spaces chat was why does Bitcoin exist and why does it need to go up to fulfill that purpose?

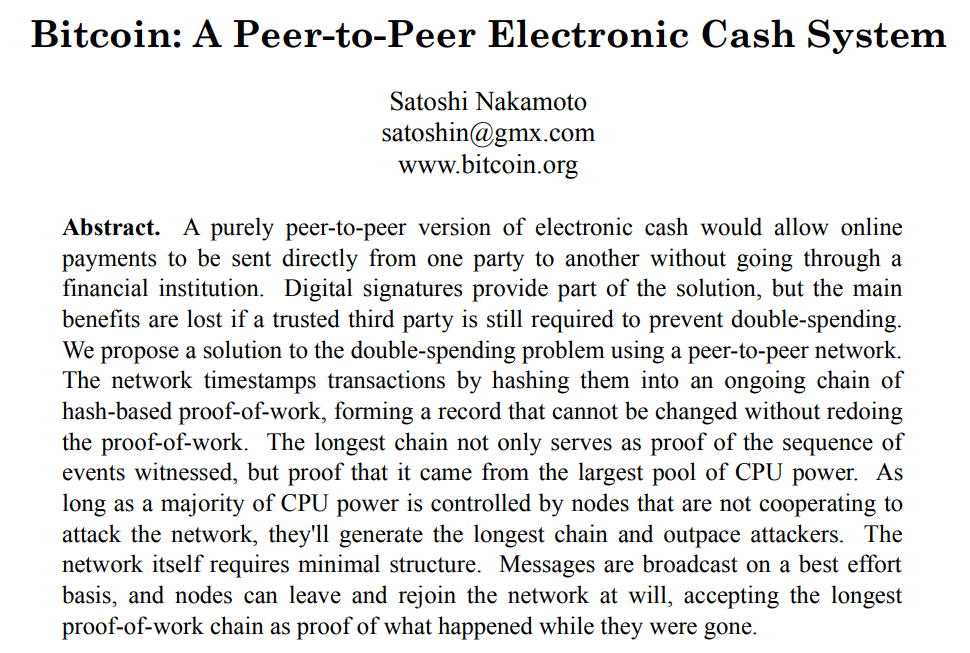

Well, the original white paper by Satoshi Nakamoto actually covers this question quite well. Here is the original white paper link.

Bitcoin Whitepaper-Satoshi Nakamoto

Did you notice the title of the paper? Bitcoin was designed to be a peer to peer electronic cash system. Nowhere in the paper does it say “a long term store of value” or “digital gold” or “the holy grail” or even “Answer to the Ultimate Question of Life, the Universe, and Everything.” And yes, we took that last question from “The Hitchhikers Guide To The Galaxy” and the answer is 42.

The point of Bitcoin was to be a way to move money around in a safe and consistent manner without needing a central authority. So why does it need to go to the moon?

Volatility

This is actually the weakest reason of any given by a long shot. Still what kind of store of value goes up or down by 30% in a day or two on a regular basis? Is this good for a peer-to-peer cash system?

Would you be happy if you were moving $1m with a bank wire because you were getting on a flight to buy a house in another state or country, and when you landed you found out that you now only have $700k because the value of the dollar dropped -30%?

From a trading perspective the volatility is great. From an investment, or store of value perspective…it looks quite poor.

Use Case

So, if BTC is supposed to be a peer-to-peer cash network, if BTC is loaded with major issues for it to be a real “store of value” then what else can it be used for? Not much. You can sling it, you can transfer it, and you can hodl it.

As it turns out you can do a ton of different things with different coins in the crypto sphere.

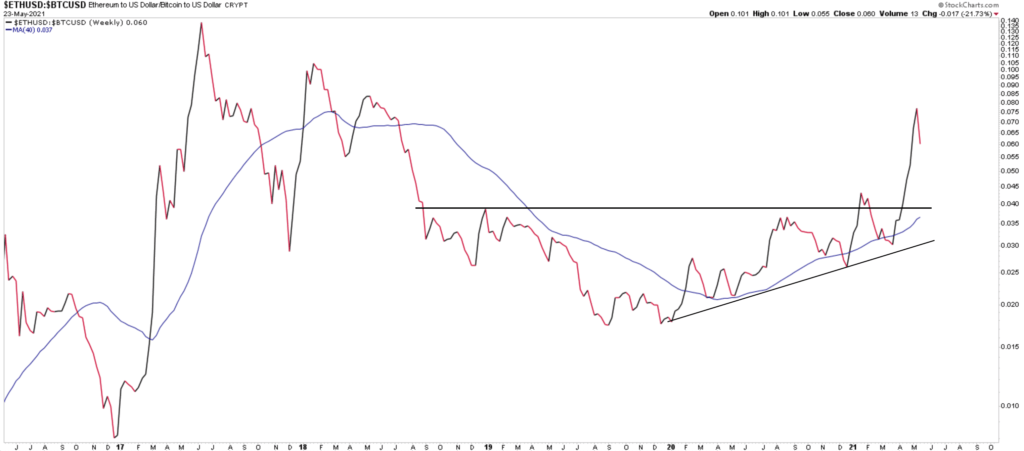

Guess what? We are not the first to figure this out. As far as we can tell investors have been realizing this for about 18-Months now. If you look at the ETH/BTC ratio you can see that Ethereum has been outperforming BTC for some time now.

There are other pros and cons, but these seem to be the big ones. We see little reason why bitcoin should be THE future of crypto, and we see a lot of reasons why it likely is not.

At the same time, we have seen several things in the broader crypto and DeFi space that will at a minimum be used by both traditional as well as new financial institutions, and could potentially revolutionize the whole space. We are not crypto bears. We just question why Bitcoin has to stay the king.