A Lesson In Bear Market Rallies

As I write this, 4/14/20, the world in general, and investors specifically, are running scared. The Covid-19 virus, the most infectious and deadly virus we have seen in years, is killing thousands of people each day and infecting many thousands more. The developed world, and massive parts of the developing world, is in lock down with everyone but essential services staying at home. Almost EVERYONE is on some form of lock down.

Because of this virus and the near sudden stop that the economy has experienced as a byproduct of the lock down markets have tanked with the SP500 having fallen -35.41% from its all time high on February 19th to its low on March 23rd. That fall translates into slightly more than -1% per calendar day.

That crash, having occurred in record time, is not why you are here. Instead we want to look at what happens once we enter a bear market. Many supposed experts, and even more non-experts, are saying that this was just the first leg and that before long we will break the lows. Many are saying that in the coming weeks there will be a lot of money to be made being short the market.

Having lived and worked through the last two recessions and their associated bear markets I thought “hmm yeah so that is not how it usually works out.” After going and charting the last several bear markets here is what I found.

Since 1980 the average bear market rally lasted 108.81 calendar days, or 3.63 30-day months. The shortest rally, and as you will see I had to stretch some definitions for this, was 12 days and the longest was 285 days. So these rallies have lasted from slightly less than half a month to almost 10 months. So what was your buddy saying about buying overpriced April or May puts?

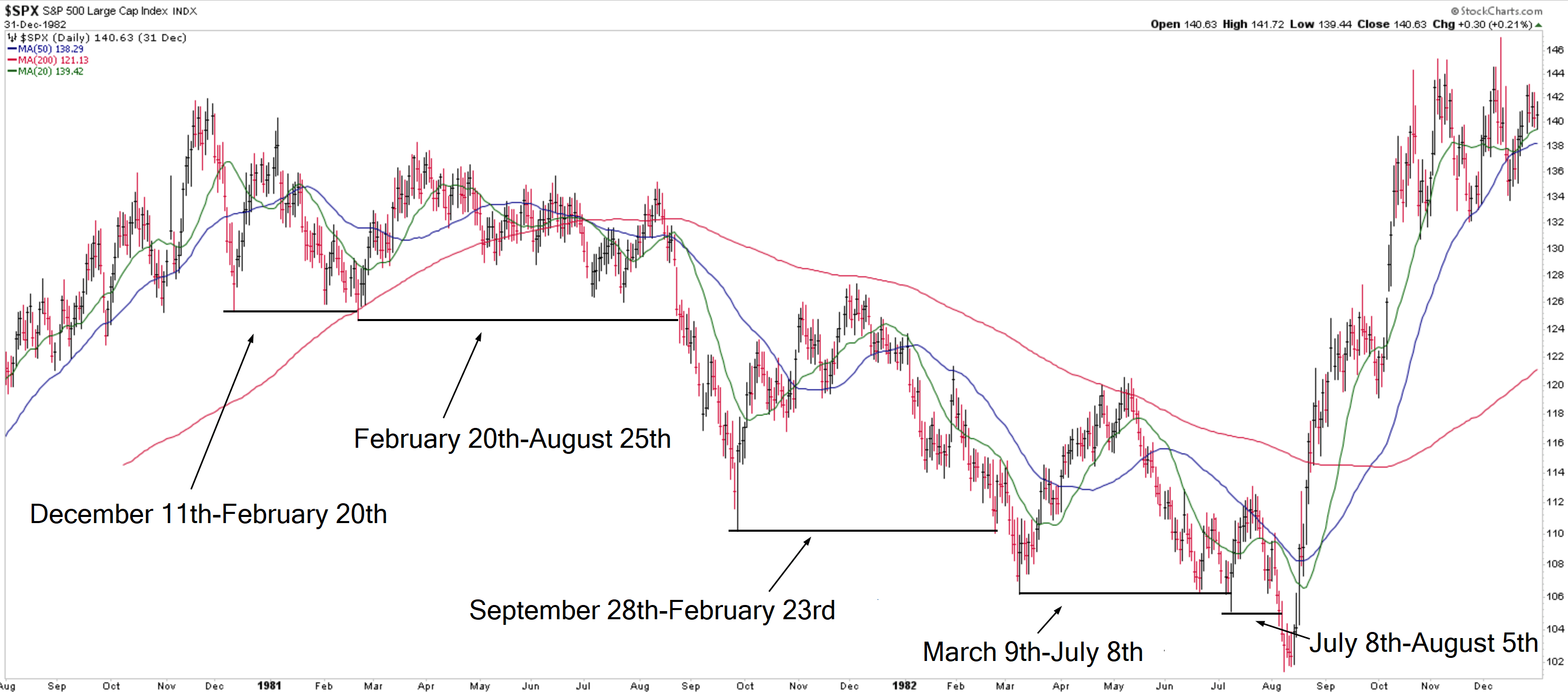

Let us look at each one. The 1980 recession lasted over 18-months and had four major lows before bottoming out. The shortest one lasted 28 days and the longest one lasted 186 days before seeing new lows with an average of 3.69 months.

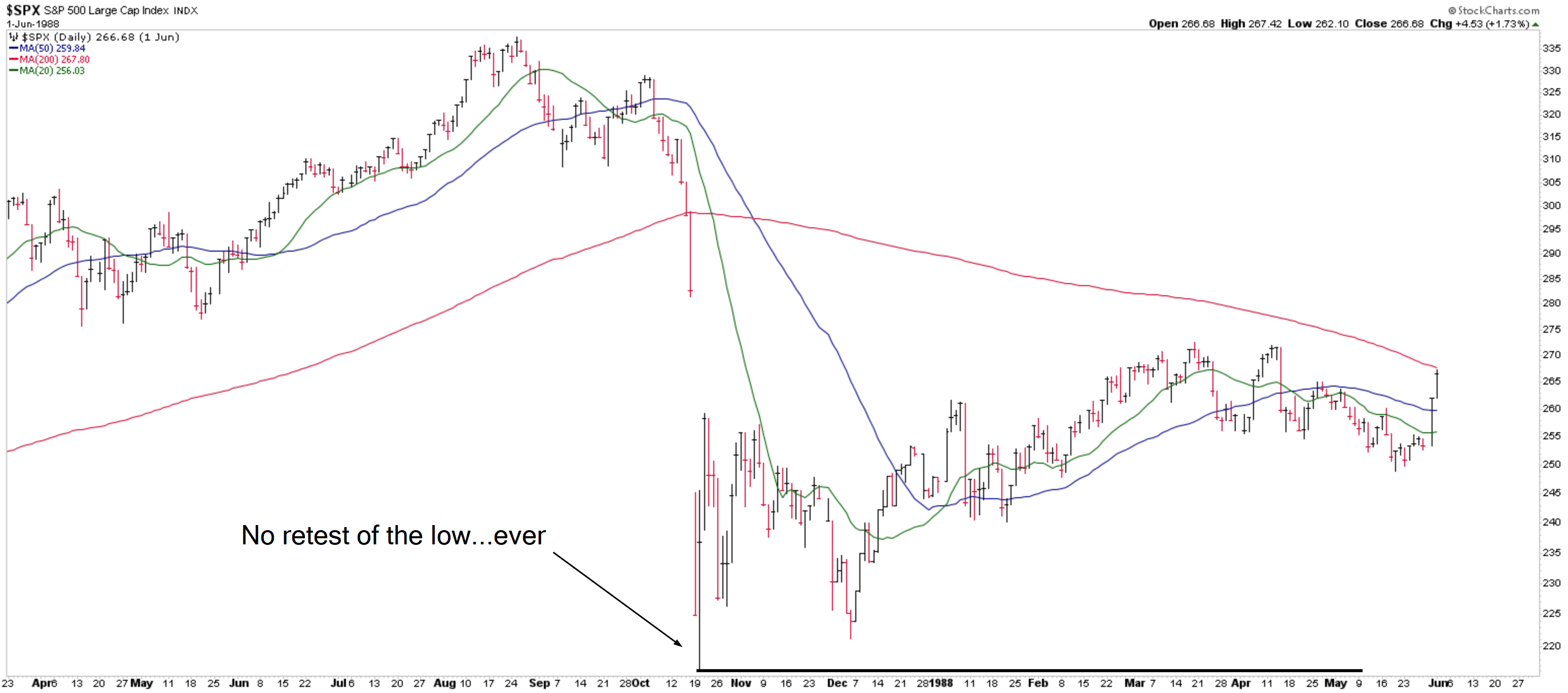

Next up we have 1987. This crash is very instructive for two main reasons. One is that it fell -35.93% in 56 days with the bulk of it in just 2 days. The second very instructive point, and it is really really big, is that after the low…we never saw a retest. Not a week later, not a few months later, not years later, and unless we see an actual nuclear war or get hit my an almost extinction level meteor attack we will never retest that low. In a week where half of Wall Street went belly up and the entire financial world was freaking out we never saw that low touched again. We saw one move lower but it turned up before hitting the low and it never looked back. Things looked really bleak and yet the market did its thing and it went up.

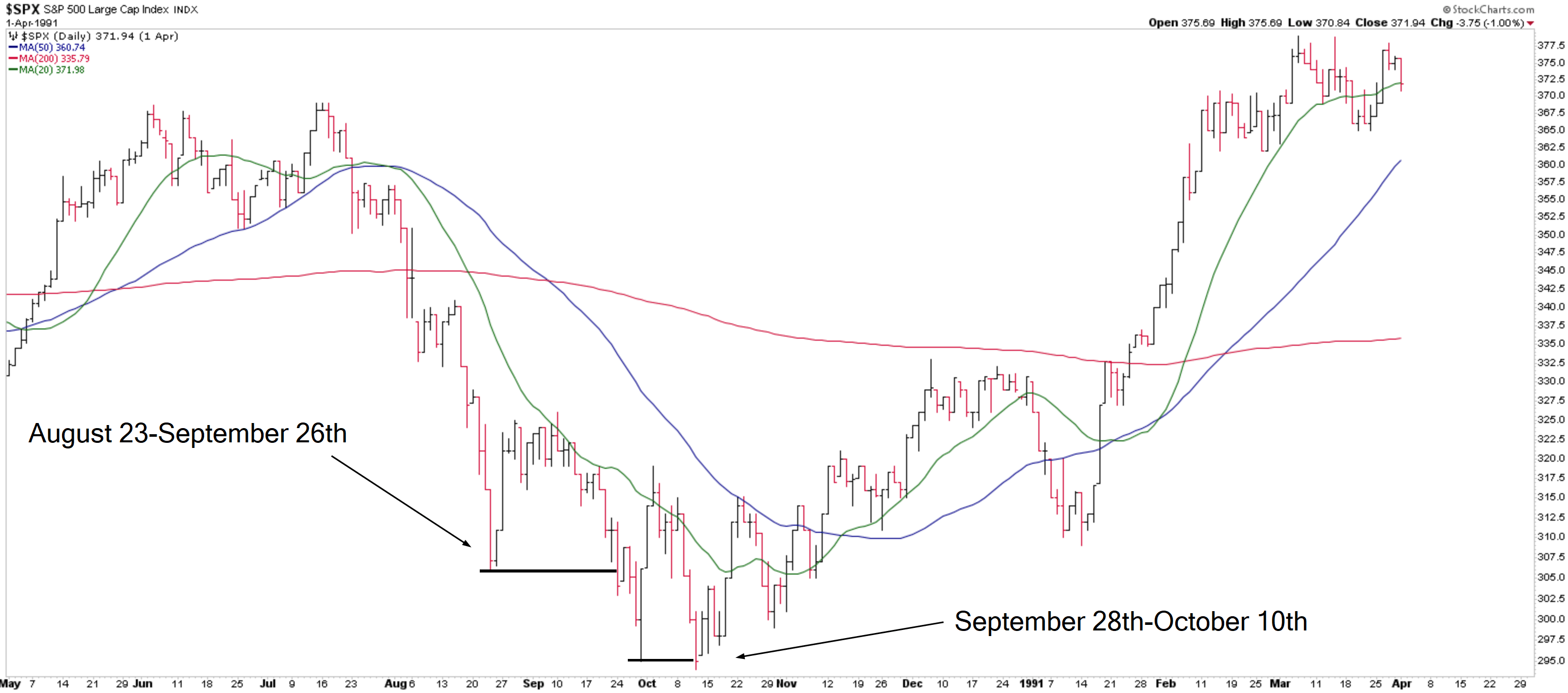

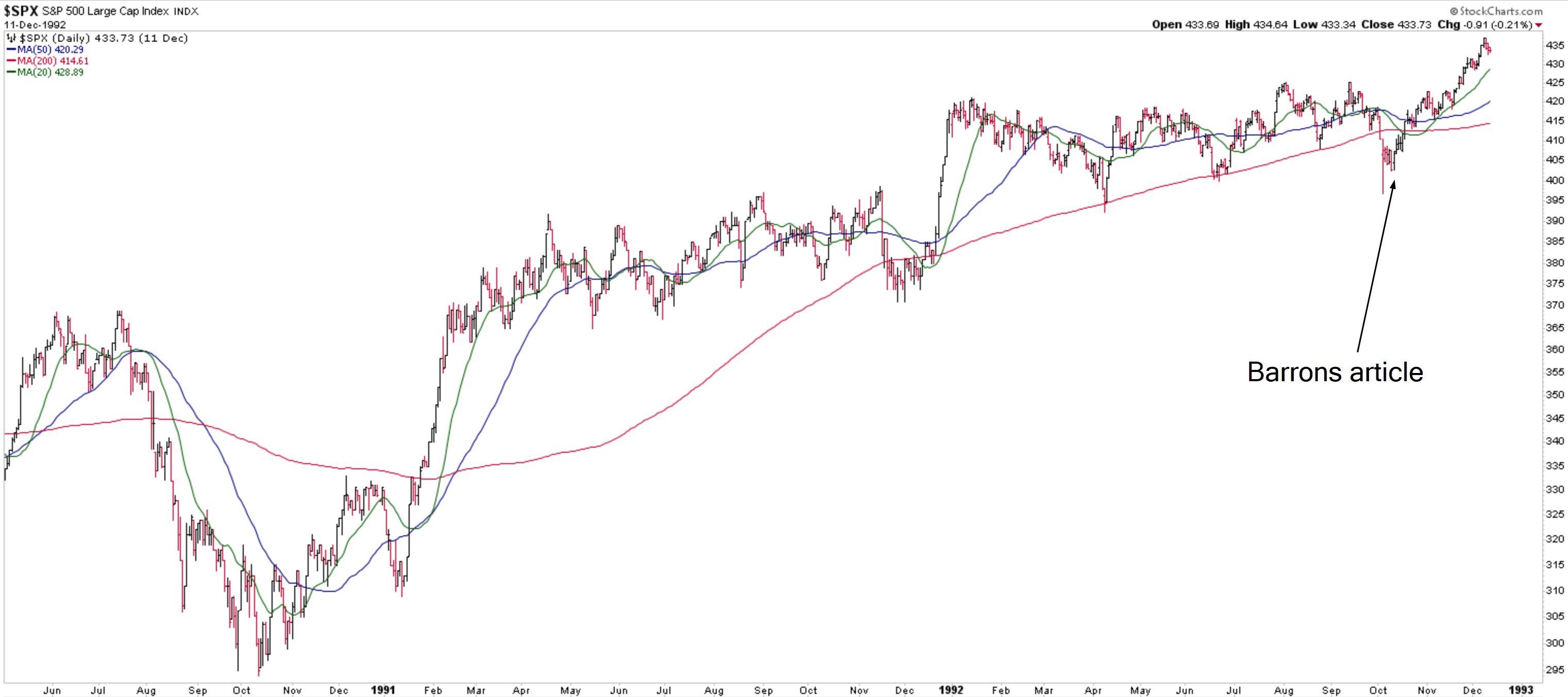

Remember how I said I had to kind of stretch the definitions? Well the 1990 recession saw a really mild bear market so I picked the lows that took more than a few days to breach. I mean the whole thing from peak to trough was only down -20.32%. One bounce lasted 34 days and the other one just 12 days. But really despite the savings and loans crisis and later on a noted HF manager calling for a depression and not a recession, the market shrugged this whole thing off and launched the 1990’s, also known as the biggest boom ever.

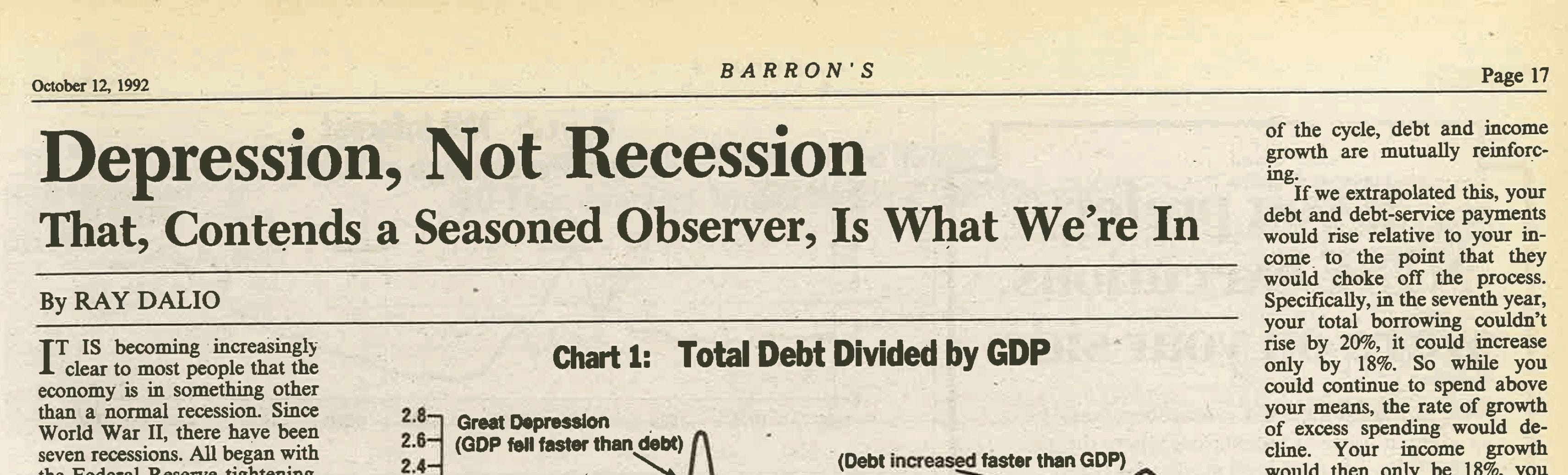

For some more historical context here is the heading of a piece by Ray Dalio in Barrons. The date is 10/12/92 and he was making a case for why we were in a depression and not a recession. In the two years leading up to this piece we had seen the Nikkei fall over -50% on its way lower, the first Iraq war, the S&L debacle, and things looked bad. Guess what did not look bad though? US stocks just shrugged it off and went on their merry way.

Here is the SP500 and you can see both the move lower in 1990 and where we were when it “seemed” as though we were entering a depression and NOT just exiting the recession and starting the greatest bull run the United States has ever seen. That whole “the market is a discounting mechanism” thing at work. The market is not always the economy. By the way this is something you might want to repeat each night after you have said your prayers and climbed into bed. I am only half joking.

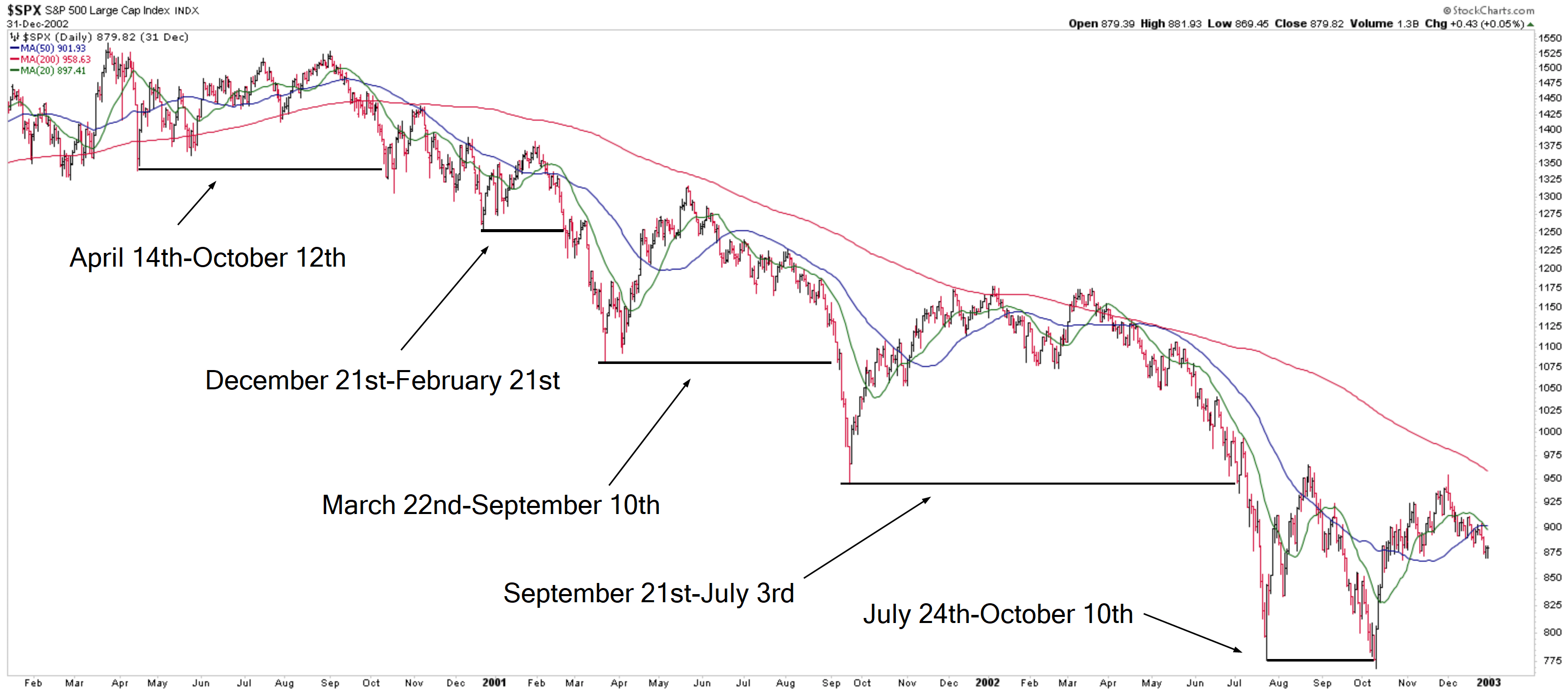

In the year 2000, after the biggest and baddest bull market in US history, we hit peak valuations, and then one day investors woke up and started selling stocks. from the peak in March to the bottom two and a half years later the SP500 dropped -50.05%. We had five major bear rallies. The longest lasted almost 10 months and the shortest lasted just over two months. The average rally lasted 5.19 months. Everyone always says “and then 9/11 hit and the market went down.” While it is true that 9/11 happened and all hell broke loose, the reality is that the market had been going down for over a year at that point. But if you had gone out and just shorted after the first break, or really almost any of the breaks, you would have endured some massive drawdowns before being vindicated. If you had bought some short, or even medium, dated puts….well you would have lost all your money.

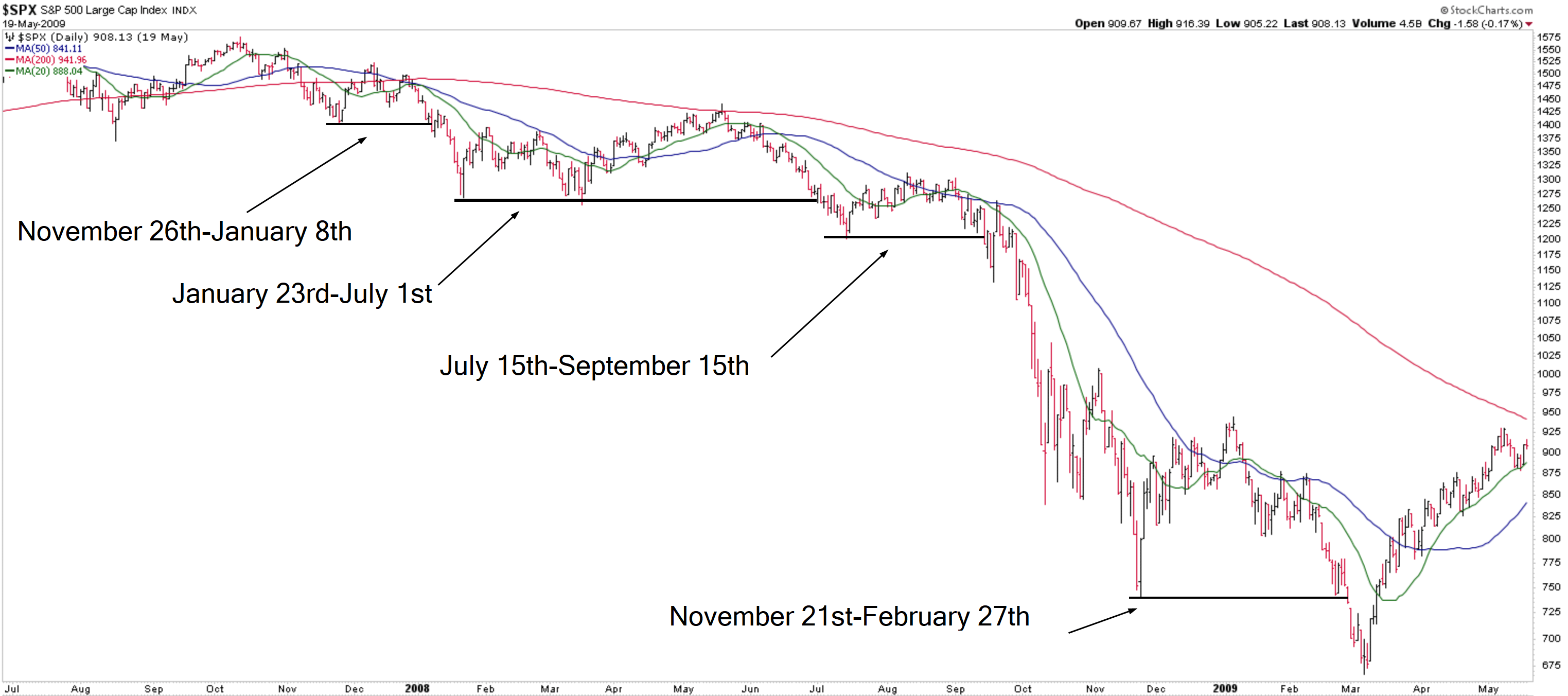

From its high in October 2007 to its low in March 2009 the SP500 dropped -57.69%. With the worst recession in a generation the market fell, fell some more, and then crashed. it was vicious and violent, and yet…it was just like most big bear markets in the sense that it had multiple long bear market rallies. Even after Lehman it took its time before finally bottoming in March. The average rally lasted 3.03 months with the longest lasting over five months and the shortest lasting six weeks. Like most of the others the market bottomed, everyone called for the next leg down, months and years later some of them were still calling for it, and then finally in the year 2020 they are all running around saying “we called it!!!”

We could have gone back to every single big move in the last century but hopefully we showed what we set out to do. Namely to demonstrate how most bear market rallies last a lot longer than people seem to think they do. Secondarily, and to a far lesser extent, we also wanted to make fun of perma-bears because that is always a good time.

By the way, after the initial break in the market in 1929, do you know what happened? We hit a closing low on 11/13/29 and did not go lower until 10/17/30, 11.27 months later.

Place your bets and you do you but make sure that you actually know how the market has performed in previous markets. Maybe we have a second leg down and maybe we don’t. But do not think that just because we hit a big low and we are definitely in a recession that we have to hit even lower lows anytime soon…or ever for that matter.

Happy Trading,

P.S. If you liked this then maybe take a free two week trial of our service. If you have any questions send me an email or find me over at Twitter @DavidTaggart

P.P.S I am not a perma-bull or perma-bear. I have found that over time neither are great things to be. Instead my main goal is to be a perma-moneymaker.