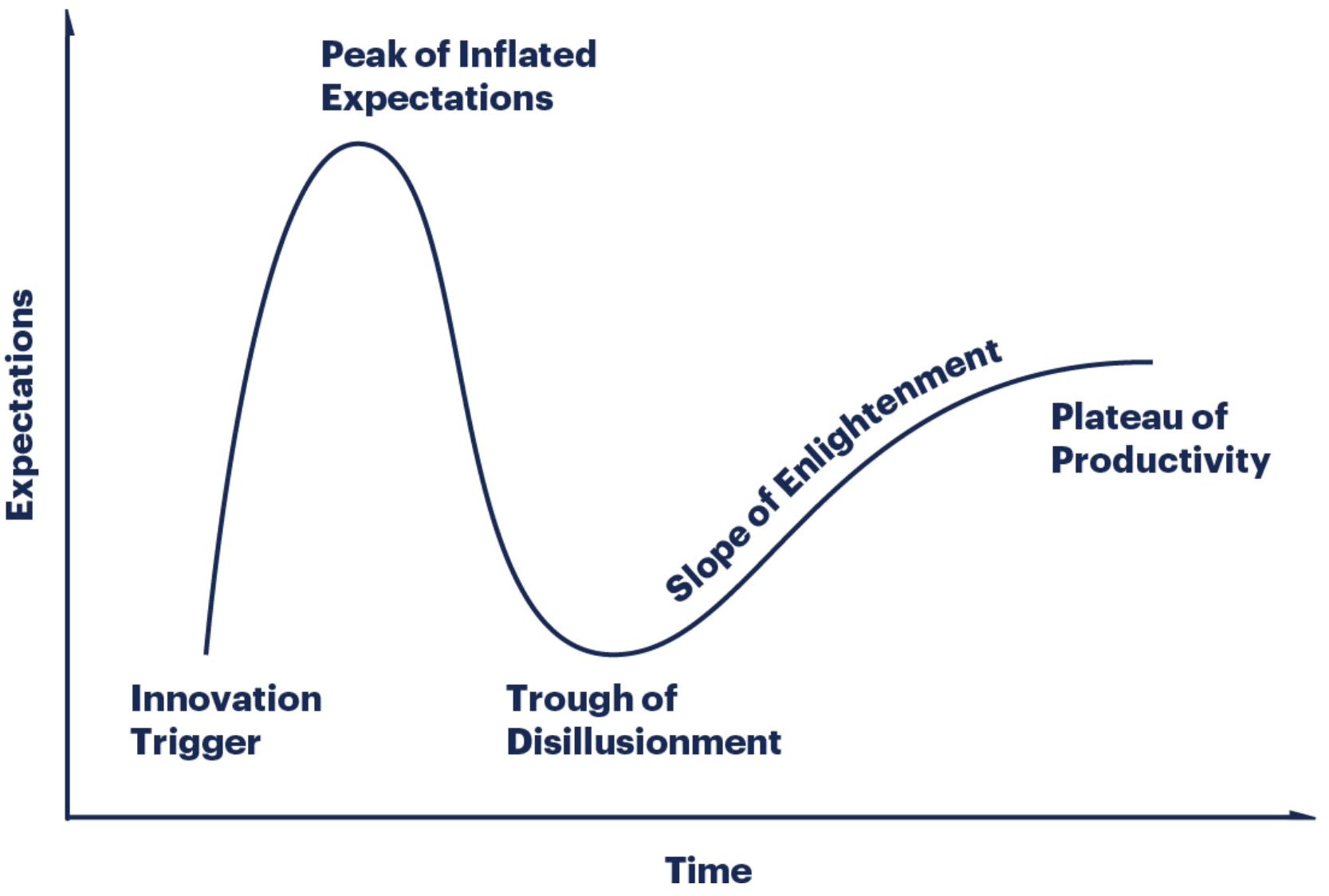

The Hype Cycle and Thematic Macro

We have all seen the pic below of the “Gartner Hype Cycle.” I am not sure how Gartner uses it and am not sure I even care, but I love the pic. It very much shows the “low risk” point of when to get into new and initially over-hyped industries. Look at it and think through some of the “the next big thing” pitches you have heard over the years.

Now think about how many of the next big things actually work out. I would venture to guess that about 10% of new industries actually become legit industries and investing opportunities while the other 90% see insane amounts of capital pour in between the innovation trigger and the peak of inflated expectations phase only to see it all vanish on the way to the trough of disillusionment.

In most cases there is nothing after than trough. A few people keep pitching it as the future but most people have moved on because there is nothing there to take into the future.

On the other hand in 10% of cases, and it might be closer to 3%, it continues to attract talent and capital during the down-cycle between the peak of inflated expectations and the trough. The believers actually believe in the new opportunity and can see where light could one day appear in the tunnel-it doesn’t have to actually be visible yet.

Too often the supposed new industry is more like a new dream with a shaky foundation and there are 99 charlatans for each serious true believer. These always end up crashing after the peak and never coming back. In a few cases you have one or two new products that people actually use but where the TAM-total addressable market is a small fraction of where the believers claimed it would be. But even there the investment thesis blew up because 1000X dollars chases a 1X dollar sized opportunity.

Yes, a few people made a bunch of money on the upswing and sold out but most lost their investment because they thought “I can be that guy” when in reality almost no one is that guy.

The better money….better in the sense that the trend can have years and decades to run and 10x-1000000x potential, is made when you invest during the back half of the trough, or if you look at the chart again right between the words “Trough of” and the word “Slope.”

If you can get in early enough once the “true” trend emerges, and by true I mean when the prospects are built on the proverbial rock and not the sand, then you have the opportunity to make several times your money and ride a multi-year if not multi-decade long trend.

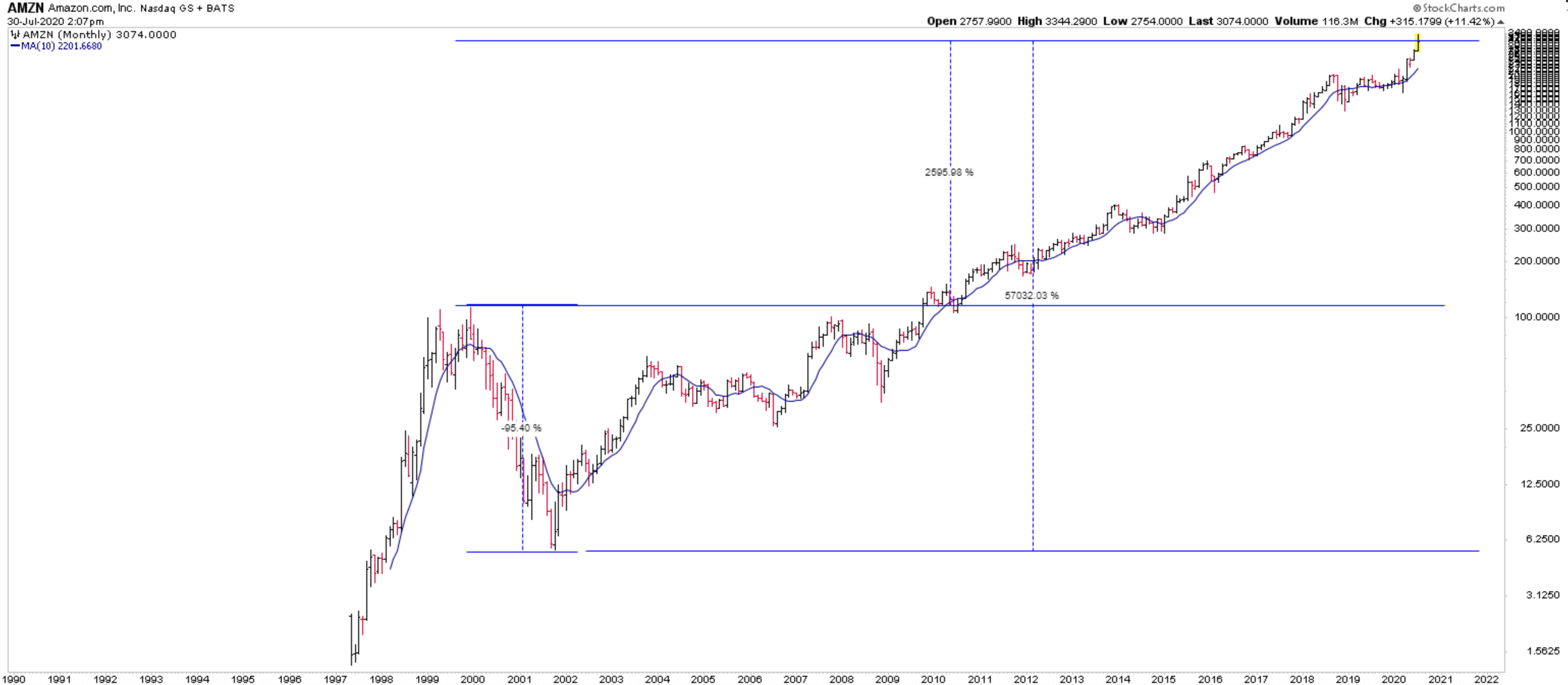

One great example, one of the best examples really, is the internet itself. It had technically existed for years but had not been consumerized until the mid-90’s. By 99-00 of course it had gone totally crazy as most of the DotCom stocks had zero earnings and zero prospects of every seeing earnings, but had sucked in insane amounts of capital. They then crashed, crashed some more, and then crashed a little bit more. If you had gone all in on a basket of these names you would have lost -90% of your money in the ensuing crash.

Yes, a few of you are saying “but look at AMZN now” and you can go run full speed into a wall. I have yet to meet or even hear of anyone whose last name is not Bezos who held their stock the entire time and came out on the other end with a bunch of money. Even if you are that one unknown investor who did hold on the entire time you still endured a -95% drawdown and “only” made half the return that someone who bought around the “trough” made. After all if you are down -95% you need to 20x your money to get back to breakeven.

Here is the deal though. If you look at AMZN around the trough, or even well after, you see a trend that goes and goes and goes. Yes, this one was one of the biggest ones ever, but there are still many that looked similar even if they did have a lower total return.

If you continue to follow budding industries you can generate some fantastic returns over time by buying them after then have crashed once or twice.

This framework is not perfect but we do know a few things that we want in our “new industry checklist.”

-Lots of money going into the hot new thing

-Lots of talent going into the hot new thing

-A crash to wash out the weak and the charlatans

-Lots of money and talent STILL going into the new thing but without the press covering it nearly as much

-Sell side going from 30 desks covering it to 1-2 desks and then the penny stock guys

-Lots of money and talent still going into it with prospects of a brighter future that actually makes sense

It is not rocket science but it is indeed hard to get the selection or the timing even remotely right. But it is the “safer” way of looking into the future.

As you may have guessed we are looking at some of these right now. If you want the short list, or make your own short list, go look at magazine covers from the last 10 years and work forwards. You might be surprised how much money and talent has continued to go into to some busted out “next new things.”

Happy Trading and Be Safe,

P.S. If you liked this then take a free two week trial of our service. If you have any questions send me an email or find me over at Twitter @DavidTaggart