Is The CRB Raw Industrial Index The Holy Grail?

So the CRB RIND-Raw Industrials Index is on the face of it one of the strangest little indices out there. It is comprised of hides, tallow, copper scrap, lead scrap, steel scrap, zinc, tin, burlap, cotton, print cloth, wool tops, rosin, and rubber. If you need to go google what some of those are, then don’t worry we aren’t going anywhere.

So the CRB Raw Industrials Index is basically made up of random stuff you need to make things, but that mostly only trade on spot markets, and most are not very liquid at all, and wool tops and tallow? Yeah I googled them the first time I read it as well.

But maybe the CRB Raw Industrials Index is such a good index precisely because it is not really influenced by traders, hedgers, etc. It is a “pure” input into industrial usage and only has the inflationary/deflationary effects of actual economic activity. As you will see it does a very good job at leading a lot of different things.

CRB Raw Industrials and SP500 Earnings Growth

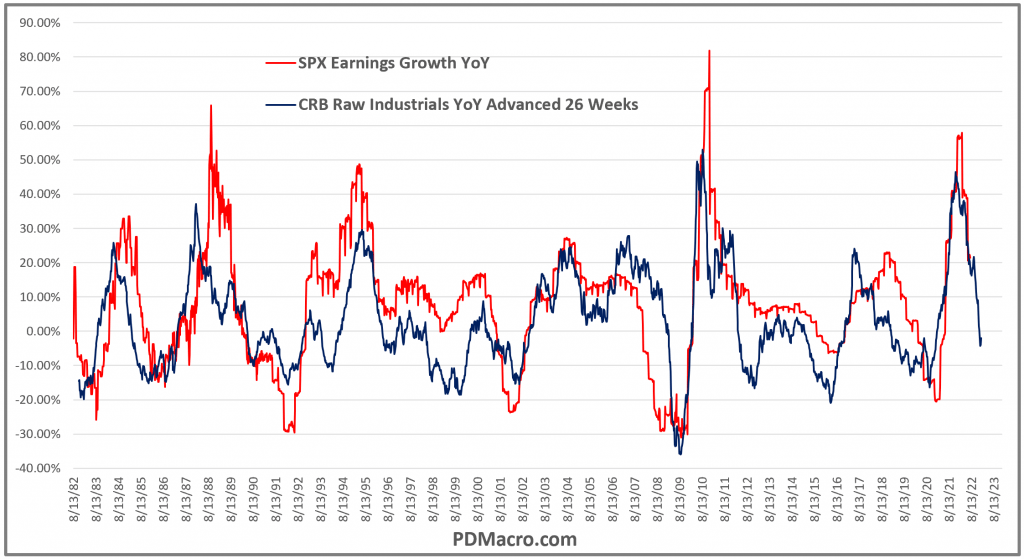

Sometimes I post a chart on Twitter that I call my stupid simple SP500 EPS model. On Twitter I always blank out the indicator, and just leave “YoY Advanced 26 Weeks.” But as you can see in the chart below the YoY CRB Raw Industrials Index advanced 26-Weeks does a good, some might say a great, job at pointing to future EPS growth rates.

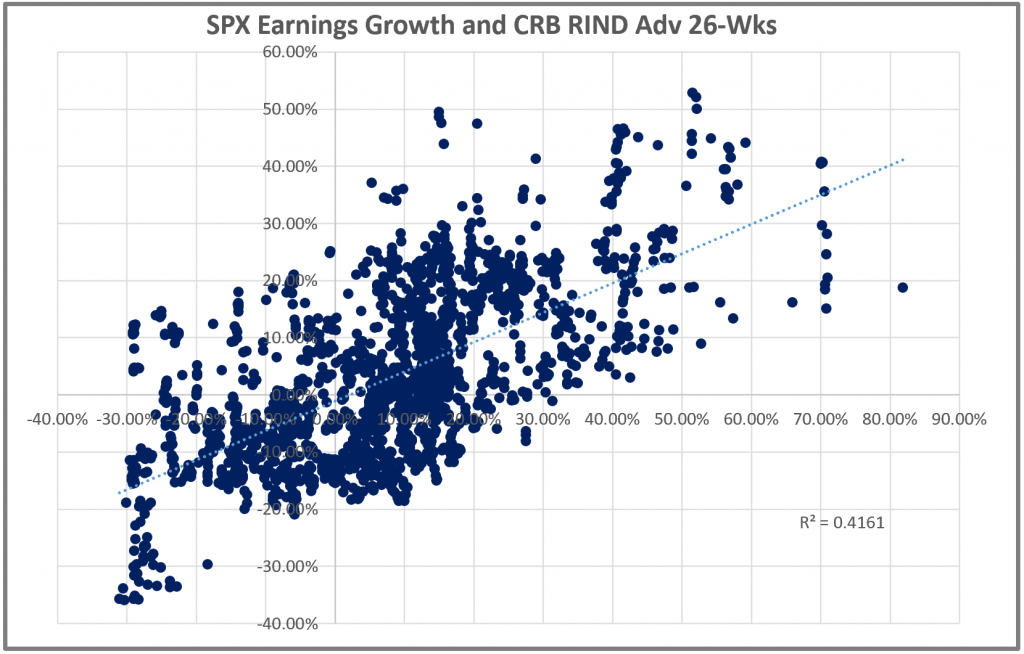

As you can see in the chart below, not only does the relationship “seem” strong, it has a R2 of 41.6%. It might not be the Holy Grail, but I am pretty sure they are friends.

It has clearly had a few misses but over the past 40 years the CRB Raw Industrials Index has done an excellent job of moving up and down ahead of earnings.

By the way you might be asking “why 26 weeks?” Good question. The way we look at moving data forward and backwards is to only do it in ways that make sense. You won’t see us move anything 37 days, but you see us move it 21 days (working days in the average month), 63 days (one quarter), 13 weeks (one quarter) and multiples of all of these. It turns out that 26 weeks equals half of a year or two quarters, so the lead time on the CRB Raw Industrials Index seems to be six months or two quarters.

Burlap and Interest Rates

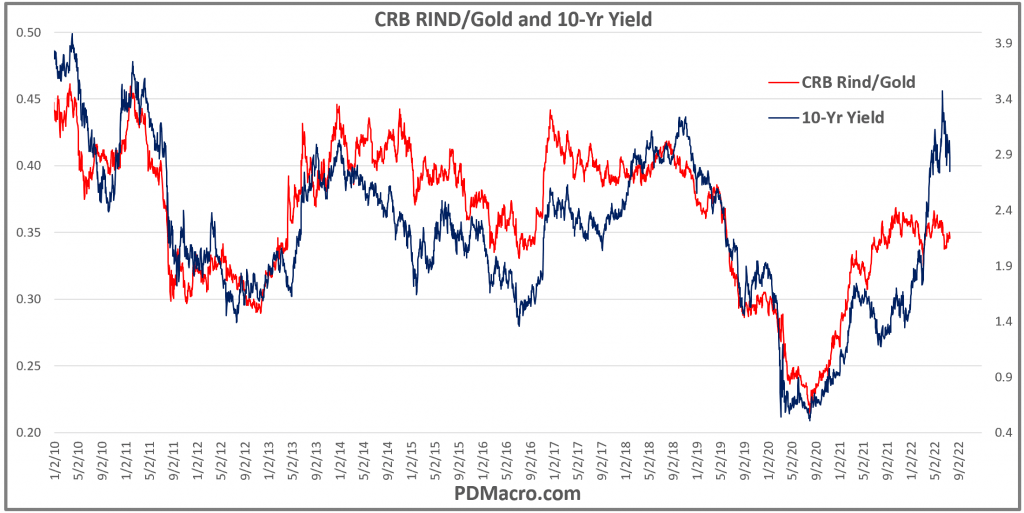

Who would have guessed that burlap and tallow were good predictors of inflation and consequently of interest rates? And yet here we are. Like the Copper/Gold ratio, the CRB Raw Industrials Index does a great job of leading interest rates. As you can see in the chart below the CRB Raw Industrials Index peaks before the 10-Yr yield, and bottoms before the 10-Yr yield. Like Copper/Gold the biggest signal value in the CRB Raw Industrials Index/Gold ratio occurs where there has been a large divergence. Some resolve quickly, some take a while, but the 10-Yr always seems to follow.

Tallow, Wool Tops, and Global Growth

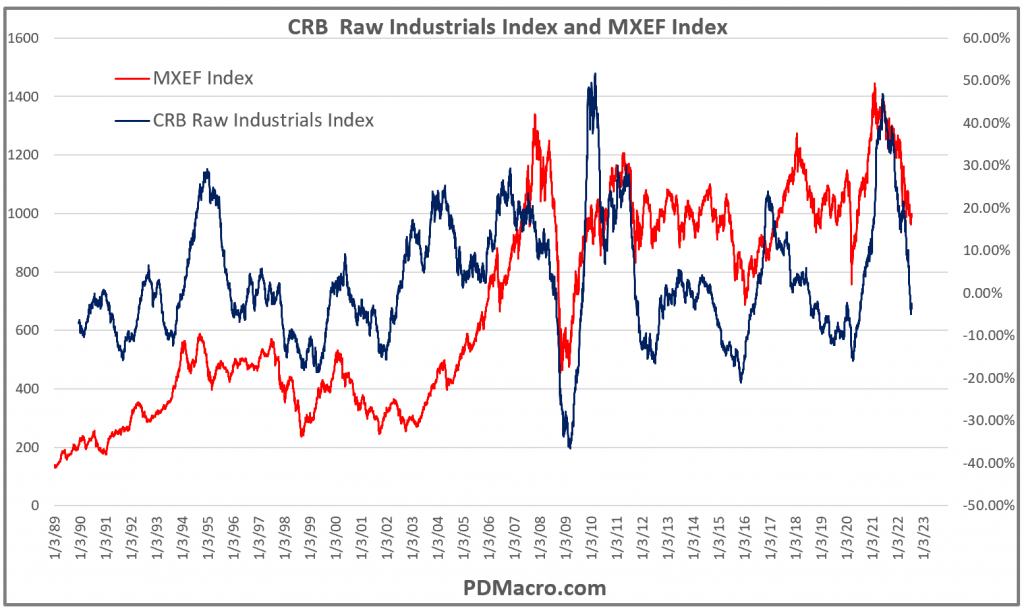

The next chart is the CRB Raw Industrials Index YoY and the MXEF-Emerging Markets Index. With the recent peak being a rare miss, the CRB Raw Industrials Index usually leads emerging markets. We actually use the CRB Raw Industrials Index a lot in our emerging market work. Along with a few other indices they do a really great job of pointing to important inflections points in EM. We will cover it in a future post but if you build a percent swing system with the CRB Raw Industrials Index and the CRB Metals Index you get some interesting EM,and really global, results.

This is the fourth in a new series of pieces we will be doing on relatively simple indicators and models that should be part of any macro traders dashboard. Nothing is the holy grail, but there are several useful tools that indicate different conditions, and the CRB Raw Industrials Index is one of the better ones. It helps inform us about the earnings cycle, emerging markets, and fixed income. Truly one of the most signal laden indices out there.

Happy Trading and Be Safe,

P.S. If you liked this then take a free two week trial of our service. If you have any questions send me an email or find me over at Twitter @DavidTaggart