We Get Paid For Taking Risks

One of the primary functions of public markets is to transfer risk. In theory we get paid for this. Someone wants liquidity and at a price, usually a decent one, some trader shows up and gives them liquidity. Are you a founder and want to take some money off the table just in case aliens land and end the need for your widget company? Anything is possible right? Well thanks to markets you can sell some of your stock and other people will share the alien technology risk with you but now you can own a house and some other stocks.

The above examples are simple but that is literally a big part of why markets exist. Price discovery and as a risk transfer mechanism. That is fine and dandy you say but you don’t take risks for random people for free. Well lucky for us the “market,” or market participants, price this into their buying and selling and on average you get paid to take on that risk.

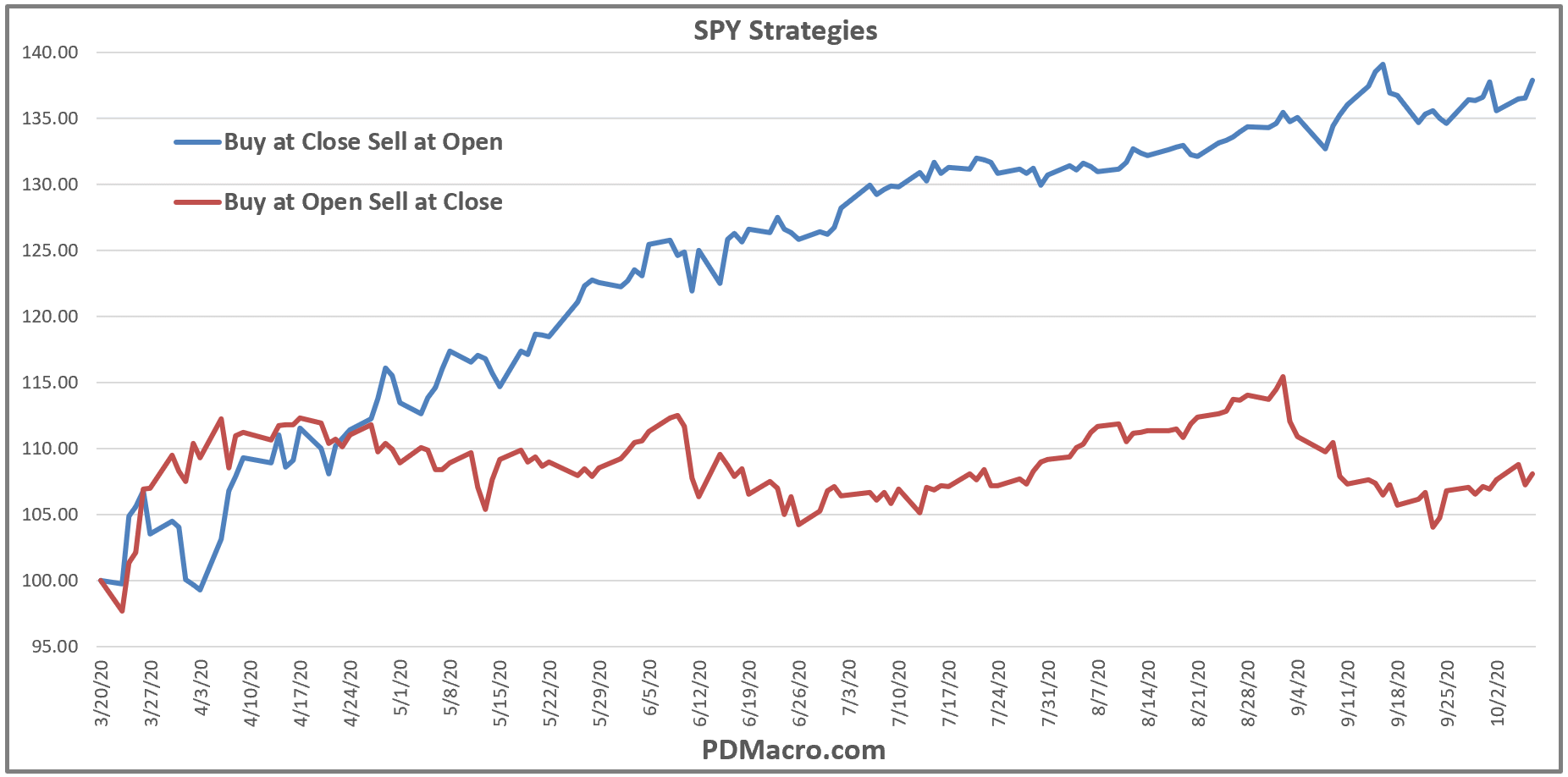

In the chart below we have five simple SPY-SP500 ETF strategies using just OHLC data. Since inception more than 100% of the SPY gains have come from holding overnight. If you had bought at the close and sold at the next days open, every trading session, you actually outperformed the SPY-SP500. You got paid for taking overnight risk when you could not sell your holdings. Even if you had a futures account For the first several years you couldn’t even hedge with Globex. You got paid to take a risk. But it gets better, or at least more interesting.

What happened if you bought at the open and sold at the close, just holding the SPY-SP500 during regular trading hours? You lost money. The market said “you have the option of buying or selling at any moment so unless you are an excellent day trader you don’t get to make any money. Most of you are not excellent day traders. If you don’t believe me call your accountant and ask how good your “day trading” really is. So holding intraday showed some gains, more losses, some gains, even more losses, etc…..and you lost money. In 27 years you lose money holding the SP500 LOL. But then you took very little risk. No risk of the aliens landing outside of a six and a half hour period of each day. No risk of war, disasters, etc., at least not outside of those 6.5 hours. If the risk transfer mechanism is a thing then this makes sense. But what about during the rona? Maybe this risk is different right?

No, it is not different. At least not in that way. Since the March bottom taking risk paid you almost all of the gains of the stock market. Incredibly it did this with less volatility than the intraday strategy.

Now none of this is investment advice. I mean you do you but this “strategy” if you can even call it that, has gone through some massive periods of underperformance. This was simply a lesson in markets and why, or at least how, we can get paid.

What you might take from this is that you want to be taking a risk, but you want to do it in smart way. Some risks are very much worth taking and others are not. You want to find the best pay vs risk taken you can and when possible, and it is definitely possible, find some relatively systemic inefficiencies where you get paid more to take a risk than it seems you should. These are the good risks. Another thing worth thinking about, but not the main topic of this post, is that some very simple strategies can give you an edge. Buying at the close and selling at the next open is not exactly rocket science level math…and yet it works.