The Most Important Chart In The World…At Least One Of Them

Each year towards year end we tend to see a lot of “the most important chart in the world” type pieces. In that spirit here is one chart that we think is one of the most important charts in the investment sphere.

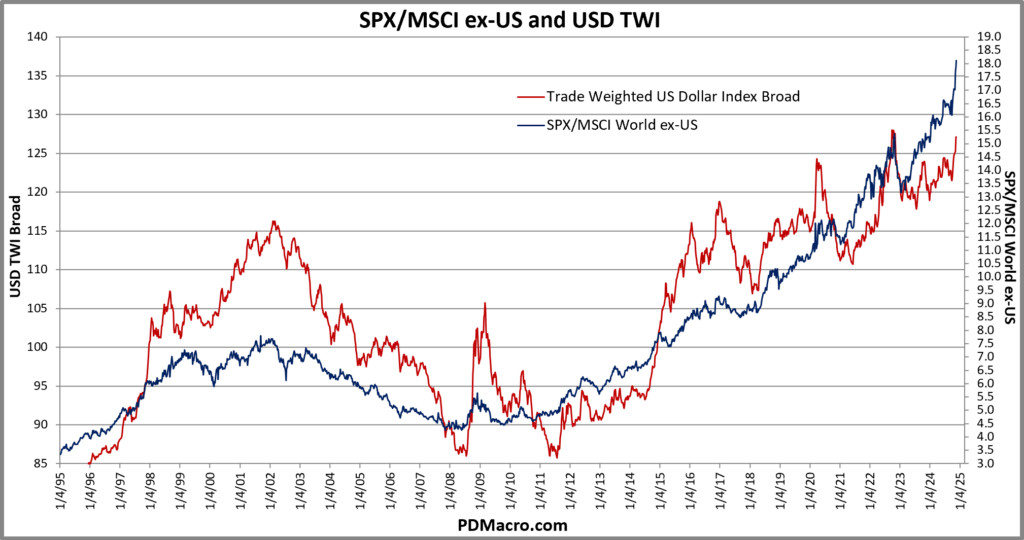

The chart is the USD overlaid with the SP500/Global ex-US Index Ratio. You can use the DXY, the BBG USD Index, or the Trade Weighted USD Broad Dollar Index. We find it tracks the latter the best, but they all say the same thing. Then you overlay it with the SP500 and World ex-USA Index ratio.

When the blue line is moving up it means US stocks represented by the SP500 are outperforming the rest of the world, and when it is going down the SP500 is underperforming the rest of the world.

The chart shows how the USD effects stock prices as well as how stock prices effect the USD. Since 1995 this relationship has been fairly strong only breaking down for short periods. Sometimes the USD leads and sometimes the equity ratio leads, but for each large swing they moved in the same direction.

This chart kind of goes against some of the research on the USD and its effects on US stocks. The research shows that a strong dollar hurts earnings for US corporations. And yet you can see that when the USD is strong, US stocks outperform global stocks.

One place where this chart and relationship should continue to shine is in asset allocation. If you are expecting the USD to turn then you probably want to overweight global stocks, if you expect it to continue higher then you probably want US stocks. There are several other takeaways, but this is the obvious one.

Worth noting is that prior to 1995 this relationship was not consistent. But with 30 years of data now, and with the relationship currently as close as ever, this is one of our nominations for the current “Most Important Chart In The World” right now.

Happy Trading,

P.S. If you liked this then take a free two week trial of our service. If you have any questions send me an email or find me over at Twitter @DavidTaggart