Do Government Shutdowns Matter To Markets?

Back during the 2013 shutdown I did a bit of work looking at how stocks did in shutdowns. After all we had not had another one in my working lifetime, and the way the media makes it seem they should be a huge deal for markets and the economy.

Turns out they are a big deal, but only in the sense that they show the electorate how bad Congress is at their job. If the shutdown lasts a few weeks, it also impacts employees and their families. But when it comes to markets they have so far been mostly a rounding error.

One thing worth nothing however is that the current one is just now hitting the all-time longest shutdown. Once you go past a month you have data collection issues, presumably different maintenance issues with equipment, etc. And we still don’t know when this will end. So saying “these are mostly a rounding error” does mean that they can’t become something bigger, just that so far they have not.

Before the 1980’s when the government had a funding gap the employees still went to work, or at most of them did. In 1981-82 the US AG Benjamin Civiletti called for more strict reading of the Antdeficiency Act. He decided that the government had no legal means to operate during a funding gap shutdown.

For instance, in 1980 under Carter there was a shutdown only of the FTC. That shutdown didn’t last a full day, but it happened. After the change of interpretation in 1982 this basically ended and now when it shuts down everyone is sent home…if there is time.

Another one, the February 9th, 2018, shutdown only lasted nine hours so no one was actually sent home.

The November 1981 shutdown was a mess due to the recent change in the way the act was interpreted. The shutdown started Friday night, but since the employees needed to come in to start shutting stuff down, they still came in on Monday, but some were sent home at lunch. Of course it was all reopened the next day.

We went back through and collected data on shutdowns, their dates, and other info. We found it interesting that there does not seem to be one comprehensive place to find all the dates as it would appear the one day or less shutdowns don’t register the same with everyone, but they still happened.

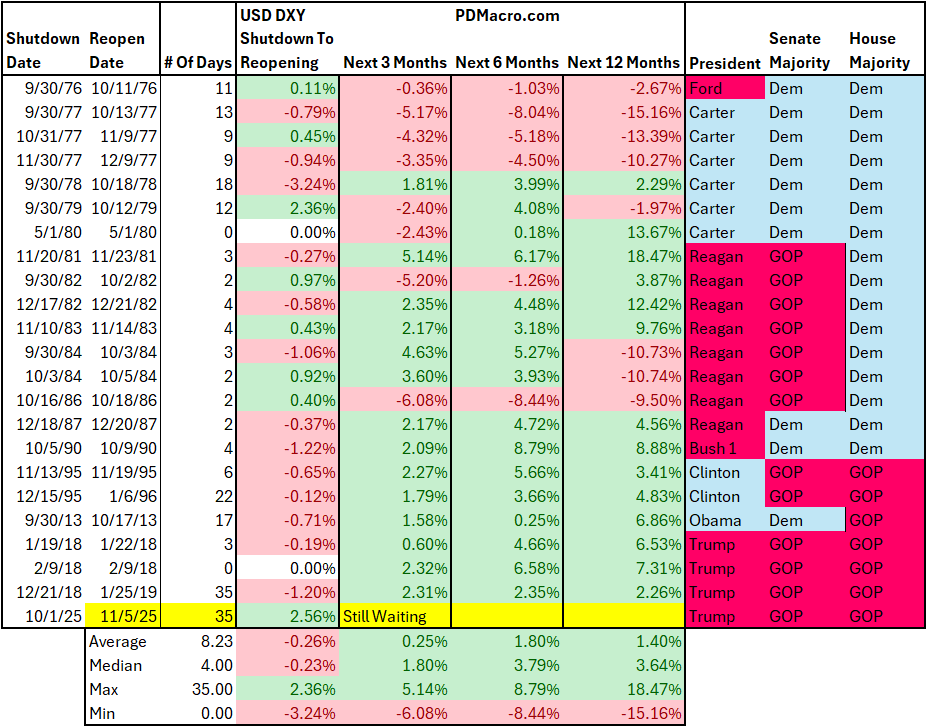

With that we took all the dates and then looked at how markets did during the shutdown, for the three months after, the six months after, and the year after. We looked at the SP500, 10-Yr Yield, Gold, USD via the DXY, and Crude Oil.

We used closing data and if the shutdown ended on a weekend, we used the Monday close, if it started on a weekend, we did the same. Most start on Fridays, but over the years we have seen them start on every day of the week.

Here is the table for the SP500. We were not able to find much in the way of actionable data. President, party, who controlled Congress, etc. didn’t seem to matter too much for the stock market.

Next up we have the bond market. If the government is shutdown does it impact government 10-Yr Yields? Not really. The prevailing trends in yields and inflation carried on as if the shutdowns didn’t exist.

What about gold? Did people run for safety? Maybe they skipped bonds because the Government was toast? We see the same thing-in the late 70’s you wanted to be long gold, in the 80’s and 90’s you wanted to be short gold-but that was the prevailing trend and it showed no real edge during the shutdowns themselves.

The DXY-USD Index table does show one interesting thing, or at least it might. Most of the subsequent 3-12 months returns are positive. So does a rising USD enable lawmakers to not do their jobs? We will look into this, but based on the other asset classes my guess is that it is more chance than anything.

Finally we have Crude Oil. We used the front month of the WTI contract and didn’t have data going back before 1983 so the earlier years are blank. If you look at the aggregate stats vs the individual years you will see that aside from one outlier-2018-19-the returns during the shutdown are noise. Going farther out the oil table has the most mixed data of all of them. More noise.

Most of the shutdowns have not lasted an entire week. The ones that have so far have maxed out at 35 days. If you go and read about each one they are mostly just one party bickering with the other party over a specific part thing that they want, but it never seems to be THE thing that will end the republic. Consequently the markets seem to just look through them.

One day this could end as a shutdown lasts months and months-the current one is not over yet- or maybe it is about something that is the end of the republic, but until then we tend to think they are more noise than signal.

Happy Trading,

P.S. If you liked this then take a free two week trial of our service. If you have any questions send me an email or find me over at Twitter @DavidTaggart